The executive teams of decentralized finance and cryptocurrency companies are currently in the most arduous search to refresh their business concepts and diversify their portfolio of services and clients. If you are interested in Cryptocurrencies, you may also consider knowing about Bitcoin.

Given this situation, it has been observed that the clients of the exchange platforms and service providers, where cryptocurrencies are the main attraction, are looking for a way to obtain greater exposure to this type of asset.

It translates into the timely and operations-based management of digital assets. Enter to Bitcoin-Prime trading system for more information.

What is Blackrock?

It is known as the largest company responsible for managing operations with assets around the world. It has recently considered establishing a partnership with the cryptographic company with the highest positioning, such as Coinbase.

This alliance is intended to offer users and professional investors of both platforms the possibility of diversifying their investments by having more manageable and more comfortable access to Bitcoin.

Specifically, this strategic alliance is aimed at institutional investors such as Aladdin, representing the exclusive group of investors that Blackrock owns, allowing them to develop any operation of buying and selling, exchange, brokerage, and custody of crypto assets that Coinbase offers.

Despite the difficult situation that Bitcoin and other cryptocurrencies have gone through, there is a high level of interest in this digital financial instrument, which is intended to visualize the various types of risk that the various crypto projects have.

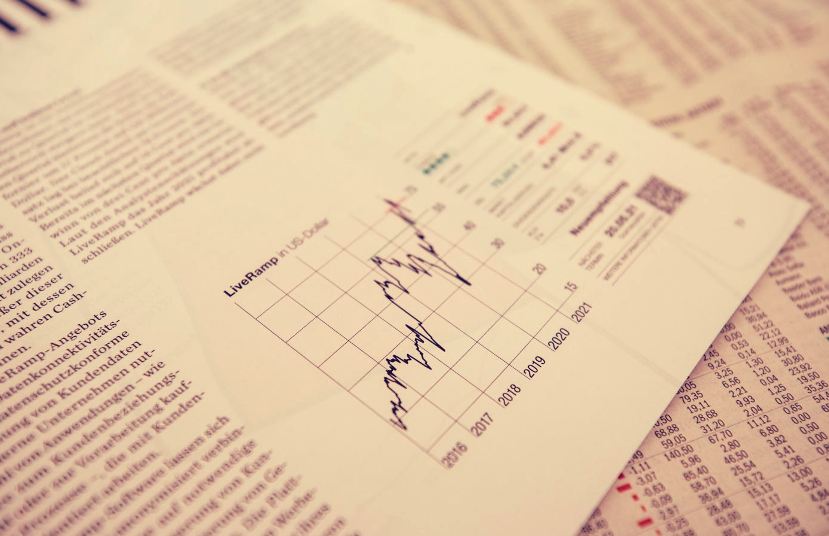

The main asset that this Blackrock Company hopes to offer its users is Bitcoin; with this type of proposal, a vote of confidence is given to Coinbase because, in its recent listings on the Stock Exchange, it has been quite affected by the valuation of crypto, assets in general.

Support to Coinbase

Over time we have observed how a group of companies in the cryptocurrency sector has been gathering and supporting what digital currencies represent as a means of payment and digital assets with high profitability potential.

Companies that have decided to place their investment and trust in what cryptocurrencies represent are MasterCard, Tesla, the financial institution NNY Mellon, and many more.

This type of institutional support tends to create an environment where the finances of all those involved tend to be strengthened, to the point that at the time of the news, the capitalization of Coinbase in the stock market increased by more than 25%, which later stabilized at 10% relatively.

It shows that although the crypto market is developing a bearish development, it is not resigned to staying there but is struggling to increase its position, which will later translate into profits since the price of crypto assets after users’ trust increases significantly.

So much so that financial entities and government entities are considering the idea of creating their digital currencies and thus establishing financial instruments based on the blockchain but centralized.

Strategic alliances of these big finance companies

The main objective of these large corporations is to establish an alliance strategy based on the Coinbase Prime and Aladdin services, where institutional investors are granted a set of benefits to make investments mainly in Bitcoin.

The possibility of acquiring cryptocurrencies in large amounts or massively will now be within reach of the members of this selective group of investors; these clients will be able to manage their cryptographic investments in a personalized way and also estimate the risk that they represent for their asset portfolio.

The CEO of the Blackrock company indicated that the positioning of digital assets, despite not being a good year, has increased, which is reflected in the intention of its clients to access these financial tools.

Blockchain technology becomes a safe and reliable option in terms of financial operations because users benefit from much lower transaction commission costs than those offered by traditional institutions. For a long time, profitability is not compared to any of the assets listed on the Stock Exchange.

Conclusion

Many crypto companies have been affected by the complex situation surrounding cryptocurrencies and their price.

Many users have sold their crypto assets out of concern that they will continue to decline and lose the amount they invested at the beginning.

This situation does not make the option of investing in cryptocurrencies less attractive and tentative, which is why alliances of this type contribute to the positioning of cryptocurrencies in the market.